Solo 401k profit sharing calculation

Solo 401 k Solo-k. On the employer or business owner side an employer profit-sharing component.

Are Discretionary Matching Contributions Becoming A Little Less Discretionary

Solo 401k profit sharing calculation Today 0156 PM.

. Solo 401ks have always been a tricky blind spot for me. Its generally about 20 of your net business income minus half of your self employment income. Determine maximum salary deferral.

With a solo 401k you are allowed to make contributions in the role of employee and the role of employer. Calculations for an S corporation and C corporation are based on the W-2 salary that is paid to the business. Specifically you are allowed to make.

A one-participant 401 k plan is sometimes called a. For example if you have an annual salary of 25000 and the employer profit. Self-employed individuals and businesses employing only the owner partners and spouses have several options for tax-advantaged savings.

An employee contribution of for An employer. Complete a Self-Employed 401 k Account Application for yourself and each participating owner including the business owners spouse if applicable. In 2022 100 of W-2 earnings up to the maximum of 20500 and 27000 if age 50 or older can.

Based on 6893852 of W-2 wages from your S-corporation for 2021 you can contribute 1723463 as a profit sharing contribution. March 15 2022 at 433 pm. Solo 401k contribution calculation for an S or C corporation or an LLC taxed as a corporation.

This is the percent of your salary matched by your employer in the form of a profit share. If permitted by the 401 k plan participants age 50 or over at the end of the calendar year can also make catch-up contributions. The one-participant 401 k plan isnt a new type of 401 k plan.

Determine maximum profit sharing contribution. You may contribute additional elective. Individual 401 k Contribution Comparison.

Maximum profit sharing contribution 25 x compensation. Because this person is making a profit sharing contribution this contribution is. This Solo 401k Contribution Calculator allows you to accurately estimate your contributions.

This worksheet helps you calculate your employer profit sharing contribution. Calculate maximum Solo 401k contribution maximum Solo 401k contribution maximum profit sharing contribution maximum salary deferral. The 2022 Solo 401k contribution limit is 61000 and 67500 if age 50 or older.

How To Calculate Solo 401k Contributions Self Employed Retirement Plan Youtube

Solo 401k Contribution Limits And Types

401 K Profit Sharing Plans How They Work For Everyone

Solo 401k Contribution For Partnership And Compensation

401 K Income Limits The Mistake Executives Earning Over 305 000 Make All The Time

Solo 401k Contribution And Deduction

Solo 401k Contribution Limits And Types

Solo 401k Calculating My Solo 401k Contributions For A Sole Proprietor My Solo 401k Financial

Solo 401k Contribution Limits And Types

Ultimate Retirement Calculator Our Debt Free Lives Retirement Calculator Retirement Planner Early Retirement

Solo 401k Contribution Limits And Types

How Much Can I Contribute To My Self Employed 401k Plan

Column Two Rival Experts Agree 401 K Plans Haven T Helped You Save Enough For Retirement How To Plan Changing Jobs Retirement Accounts

Solo 401k Contribution Calculator Solo 401k

Solo 401k Contribution Limits And Types

How Much Can I Contribute To My Self Employed 401k Plan

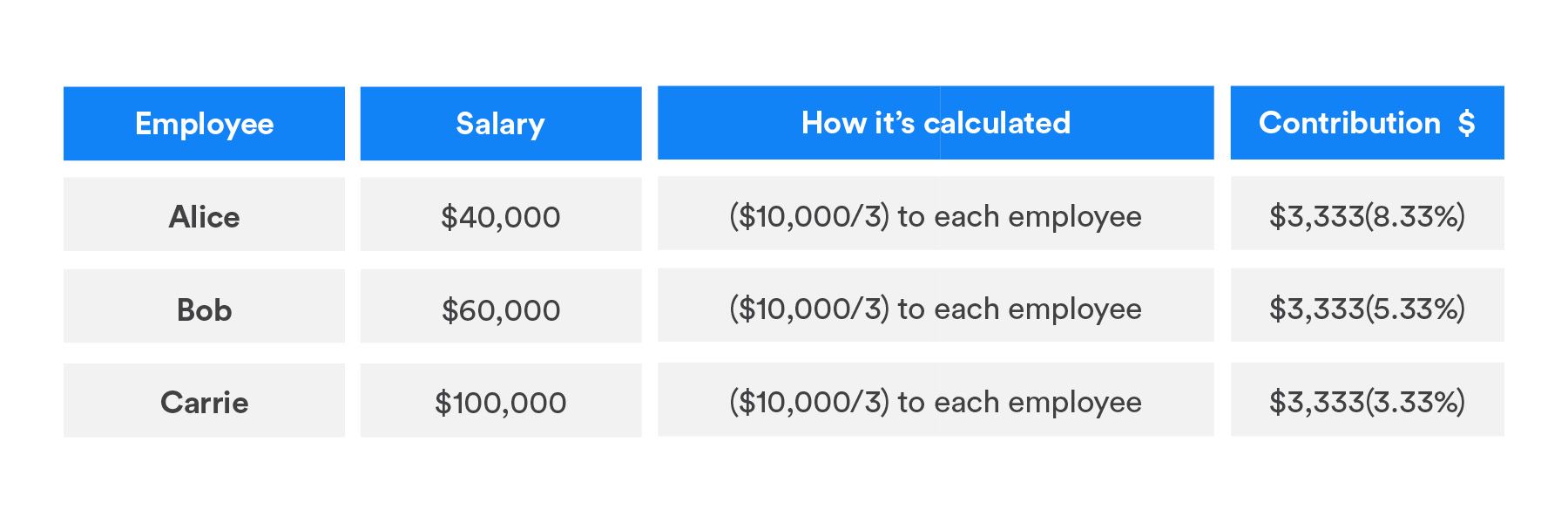

What Is A True Up Matching Contribution